Digital onboarding for EAM and HNWI clients

User-friendly and intuitive solution which enables a range of External Asset Managers (EAM) to onboard

clients to a third party/custodian bank faster while maintaining regulatory compliance.

The digital onboarding solution was designed as a flexible application that allowed EAMs to:

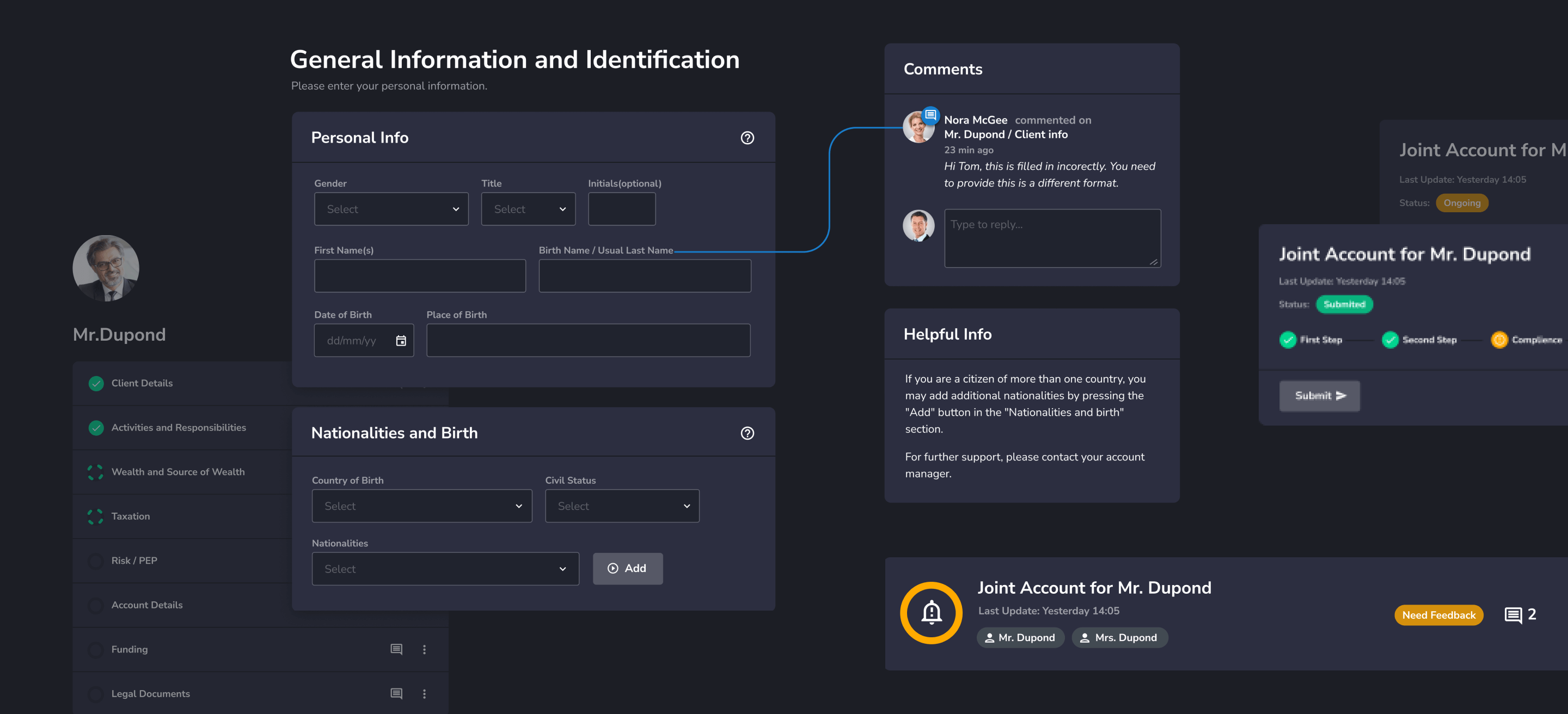

- Capture client data

- Print client documents for reviews and reports

- Submit completed applications directly to the bank

- Transparently monitor the progress of applications

The application was developed to align with the existing bank design standards.

Acknowledging the importance of making it easy to comply with all prevailing rules and regulations, the solution provided automated workflows across KYC/AML and legal profiling.

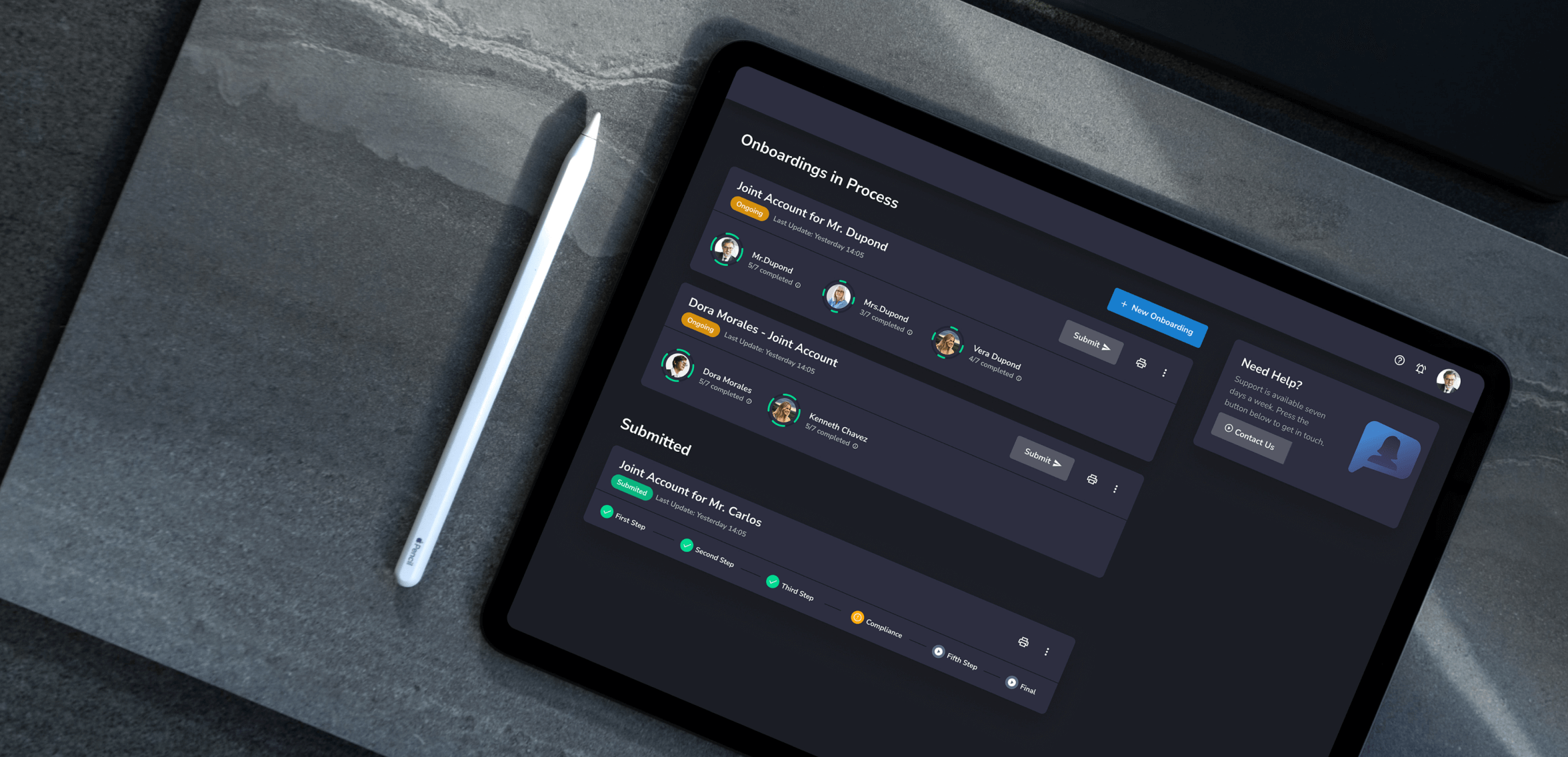

Application status

Deep dive into open onboarding forms, already submitted, or start a new application.

Automated workflow

Fast and secure. Allow EAMs to view status and progress. Add users and assistants. Check all “to do” tasks, view recent activities and who has done what. View the list of required documents, upload them, and also provide answers to KYC questionnaires online.

Smooth Collaboration between Bank and EAM

Allow the bank to pre-check clients, comment on KYC forms, assist in completing documents, and view the status and progress of applications.

Impact

Our solution created significant engagement in the community. That was The solution was another successful step along the digital enablement journey for the bank:

- A highly simplified, quicker onboarding process

- Quicker responses to customer queries

- Greater transparency about the application status and missing elements

for all the participants - Greater support for the EAM from the bank